Mind the deductible.You can raise your policy’s deductible to lower the premium, but independents should weigh their risk in an accident with multiple claims. For example, separate $2,500 deductibles on a tractor, a trailer and cargo easily could come into play at once, yielding a $7,500 bill. Leased operators should know if their carrier holds them responsible for a certain amount of carrier liability or cargo deductibles in a loss.

Keep credit history clean. Credit reports often are pulled by underwriters to determine owner-operator insurance rates. Pay your bills on time, and follow other practices to maintain a high credit score.

Include aftermarket items in stated value. When you determine fair market value during policy updates, use online and dealer resources to help determine aftermarket add-ons’ real effect on your rig’s resale value. Also, enhancements that would lower the insuror’s exposure, like deer catchers and anti-theft devices, can bring rate discounts.

Account for safety. Don’t be shy about communicating a strong safety record during any rate quote or policy update.

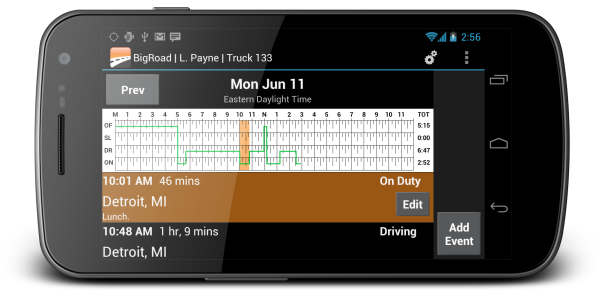

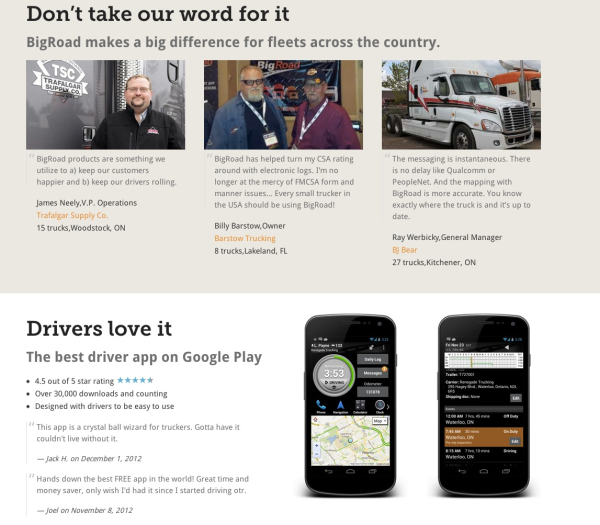

Use technology to protect your CSA scores and improve Safety. Affordable electronic log apps like smartphone based BigRoad is a good first step toward proactively managing your driver logs, CSA scores and reducing your compliance liability

Compare rates. As with anything you buy, it’s wise to compare rates periodically. Before changing insurors, see if your current one offers a discount for staying with the company.

Update business information. Type of freight, miles driven and area of haul are factors that affect the accuracy of your rates.